Repo rate

08 Aug 2024 | 10:44:33 AM IST

LIVE BLOG: RBI Monetary Policy Update – Repo Rate Unchanged; UPI Tax Payment Limit Increased

Date: August 7, 2024

Overview:

The Reserve Bank of India (RBI) has announced its latest monetary policy decisions today, highlighting two significant updates: the repo rate remains unchanged and the tax payment limit via the Unified Payments Interface (UPI) has been increased from ₹1 lakh to ₹5 lakh per transaction. This live blog will provide real-time updates and analysis of these announcements, their implications for the economy, and the responses from various stakeholders.

11:00 AM – RBI’s Press Conference Begins Repo rate

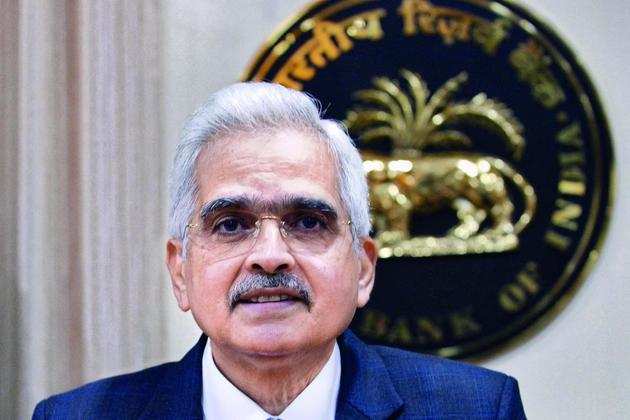

RBI Governor Shaktikanta Das is addressing the media. The key points of the announcement are:

- Repo Rate Decision:

- The RBI has decided to keep the repo rate unchanged at 6.50%. This decision is in line with the consensus among economists and market analysts who anticipated a pause in rate adjustments.

- UPI Tax Payment Limit Increase:

- The Monetary Policy Committee (MPC) has approved an increase in the UPI tax payment limit from ₹1 lakh to ₹5 lakh per transaction. This move is aimed at facilitating larger transactions and improving the convenience of digital payments.

- 11:15 AM – Key Reasons for the Repo Rate Decision Repo rate

- Inflation Control:

- The RBI has stated that the decision to maintain the repo rate is driven by ongoing concerns about inflation. While inflation has moderated, the central bank is cautious about making any abrupt changes that could disrupt economic stability.

- Economic Growth:

- The RBI’s assessment indicates that economic growth is stable, and the current repo rate level is deemed appropriate to balance growth and inflation.

- Impact on Businesses:

- Businesses that handle large transactions will benefit from the higher limit, reducing the need for alternative payment methods and potentially lowering transaction costs.

- Consumer Convenience:

- Consumers will now be able to make higher-value payments directly through UPI without needing to use other payment channels, enhancing the ease of transactions.

12:00 PM – Market Reactions

Table of Contents

- Stock Market Response:

- The stock markets are showing a positive reaction to the RBI’s decisions. The unchanged repo rate is seen as a sign of stability, while the UPI payment limit increase is viewed as supportive of economic activity.

- Bond Markets:

- Bond yields have remained relatively stable. Investors are interpreting the RBI’s decision as a sign of continuity in monetary policy.

12:30 PM – Expert Opinions

- Business Leaders:

- Business leaders are expressing satisfaction with the higher UPI payment limit. They believe it will simplify transactions and reduce reliance on cash and

- Consumer Advocacy Groups:

- Consumer groups are praising the RBI’s decision to enhance UPI payment limits, highlighting that it will improve the ease of making large payments and contribute to the growth of digital payment systems.

1:00 PM – RBI’s Future Outlook

- Inflation Monitoring:

- The RBI has emphasized its commitment to monitoring inflation closely. The central bank will continue to assess economic conditions and may adjust its policy stance if necessary to address inflationary pressures.

- Economic Growth Projections:

- The RBI’s outlook on economic growth remains positive, with expectations for moderate growth in the coming quarters. The central bank will balance its policies to support sustainable growth while managing inflation.

- Global Economic Influences:

- The RBI will remain vigilant of global economic developments, including changes in international commodity prices and geopolitical events, which could impact India’s economic outlook.

2:00 PM – Reactions from Financial Institutions

- Banks:

- Banks are expected to maintain their lending rates at current levels, given the unchanged repo rate. They will likely adjust their deposit rates in response to market conditions and competition.

- Payment Service Providers:

- Payment service providers are gearing up to accommodate the increased UPI payment limit. This change is anticipated to drive higher adoption of digital payment solutions for larger transactions.

3:00 PM – Government Statements

- Finance Ministry:

- The Finance Ministry has endorsed the RBI’s decisions, noting that they align with the government’s goals of promoting digital payments and maintaining economic stability. The ministry supports the RBI’s cautious approach to monetary policy.

- Digital India Initiative:

- The increase in UPI payment limits is seen as a significant step in the Digital India initiative. The government is expected to continue supporting digital payment innovations to further financial inclusion and ease of transactions.

4:00 PM – Public and Media Reactions

- Public Opinion:

- Public reaction to the UPI limit increase is generally positive. Many people appreciate the convenience of being able to make larger payments through digital platforms.

- Media Coverage:

- Media coverage is focusing on the RBI’s balanced approach to monetary policy and the potential benefits of the increased UPI payment limit. Analysts are providing in-depth analyses of the implications for various sectors.

5:00 PM – Key Takeaways and Summary

- Repo Rate Unchanged:

- The RBI’s decision to keep the repo rate unchanged reflects a cautious stance on inflation and economic stability. The central bank aims to support growth while keeping inflation under control.

- UPI Payment Limit Increase:

- The increase in the UPI payment limit from ₹1 lakh to ₹5 lakh per transaction is expected to enhance the convenience of digital payments for both individuals and businesses. This move aligns with broader efforts to promote financial inclusion and digital transactions.

- Future Monitoring:

- The RBI will continue to monitor economic conditions and adjust its policies as needed. Stakeholders should stay informed of further updates and developments related to monetary policy and digital payment regulations.

Conclusion:

The RBI’s monetary policy decisions today reflect a balanced approach to managing economic stability and promoting digital financial inclusion. While the repo rate remains unchanged, the significant increase in the UPI payment limit is expected to positively impact the ease of transactions and support economic activity. As the situation evolves, ongoing monitoring and updates will be crucial for understanding the full implications of these policy changes.