### White House Issues New Student Debt Relief Plan Ahead of 2024 Election, Says Millions May Qualify

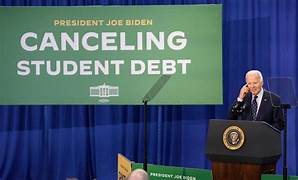

In a significant move ahead of the 2024 presidential election, the White House has unveiled a new **student debt relief plan** designed to provide relief to millions of borrowers across the United States. The announcement, made in late 2023, comes as part of President Joe Biden’s ongoing efforts to address the growing issue of student loan debt, which has reached more than **$1.7 trillion** nationwide. The new plan is expected to impact millions of borrowers, especially those who were previously ineligible for relief programs or facing financial hardship due to the COVID-19 pandemic and subsequent economic downturn.

### The New Debt Relief Plan: Key Features

The Biden administration’s latest debt relief plan builds on the **Income-Driven Repayment (IDR)** plans and previous debt forgiveness efforts, with some notable adjustments aimed at broadening eligibility and accelerating relief. Here are the key features of the plan:

#### 1. **Expanded Income-Driven Repayment (IDR) Plan**

One of the central components of the new debt relief plan is an expansion of the **Income-Driven Repayment (IDR) system**, which ties monthly loan payments to a borrower’s income and family size. The plan simplifies the existing IDR options and provides more generous terms for many borrowers, particularly those who earn low to moderate wages.

– **Lower Monthly Payments**: The new IDR plan reduces the monthly payment cap from 10% of income to 5% for many borrowers, which could significantly lower payments for those earning less.

– **Shorter Repayment Period**: The plan reduces the number of years needed to qualify for loan forgiveness. Borrowers who make payments under the new system for **20 years** (down from 25 years in previous plans) will have their remaining balance forgiven.

– **Inclusion of All Federal Loans**: For the first time, the new IDR plan includes **Parent PLUS loans**, which were previously excluded from many of the forgiveness programs, thus benefiting

#### 2. **Automatic Enrollment and Adjustments for Borrowers**

In an effort to simplify the system and ensure more borrowers receive the relief they’re entitled to, the new plan includes **automatic enrollment** into the expanded IDR program. This means that borrowers who are already in repayment may be automatically switched to the new plan without needing to apply. For borrowers who were previously enrolled in a different repayment program or were in default, this could provide much-needed relief without requiring additional paperwork or applications.

Additionally, the plan includes automatic **interest rate reductions** and **temporary payment adjustments** for borrowers who have been unable to make regular payments due to financial hardship or the pandemic.

#### 3. **$10,000 Forgiveness for Low-Income Borrowers**

One of the most widely publicized aspects of the new plan is the expansion of **one-time forgiveness** for borrowers who meet certain income thresholds. The administration is offering up to **$10,000 in debt forgiveness** for individuals earning under **$125,000 per year** or families earning under **$250,000** annually.

– **Eligibility**: This forgiveness is available for borrowers with federal student loans who meet the income requirements, and it applies to loans held by the federal government (not private student loans).

– **Direct Relief**: Borrowers who qualify will receive automatic forgiveness, meaning they don’t need to submit an application, though they will be required to verify their income if requested.

This $10,000 forgiveness plan follows a similar initiative launched earlier in the Biden administration and is expected to significantly reduce the debt burden for many individuals who still face high loan balances, particularly those from historically marginalized communities.

#### 4. **Temporary Relief for Borrowers in Default**

For borrowers who are in **student loan default**, the new plan provides a **temporary forbearance** period, during which the government will temporarily halt collection efforts. This includes:

– **Suspension of Garnishment**: The plan suspends wage garnishment and tax refund offsets for borrowers who have defaulted on their loans, providing immediate financial relief.

– **Loan Rehabilitation Program**: Borrowers in default will also have access to a streamlined loan rehabilitation program that can help them return to a good standing with their loans. This could help them get back on track with repayment without the negative consequences of default, such as damaged credit scores.

This is especially important given that a large number of borrowers have fallen behind on their student loans, particularly following the COVID-19 pandemic and the subsequent economic hardships faced by many.

—

### Why the Timing Is Crucial: Election Year Politics

The timing of the new student debt relief plan is not coincidental. With the 2024 election on the horizon, President Biden is facing increasing pressure from progressive activists, student advocacy groups, and a large base of young voters who have long been calling for a resolution to the student loan crisis.

**Political Context**:

Student loan debt has become a major political issue in the United States, especially among younger voters, many of whom feel that the weight of their education loans has hindered their ability to achieve financial stability, buy homes, or save for the future. According to a **2023 survey by the Pew Research Center**, nearly 50% of Americans aged 18 to 29 report having student debt, and for many, the outstanding balances are a significant source of financial stress.

Table of Contents